Which Best Describes a General Partnership

Earn 20 pts. Which advantage of a sole proprietorship could also be a disadvantage.

General Partnership Vs Limited Partnership Harvard Business Services

A general partnership the basic form of partnership under common law is in most countries an association of persons or an unincorporated company with the following major features.

. Which statement best describes their legal situation. Recall 7 Adams was approached by a Mr. Which best describes a sole proprietorship.

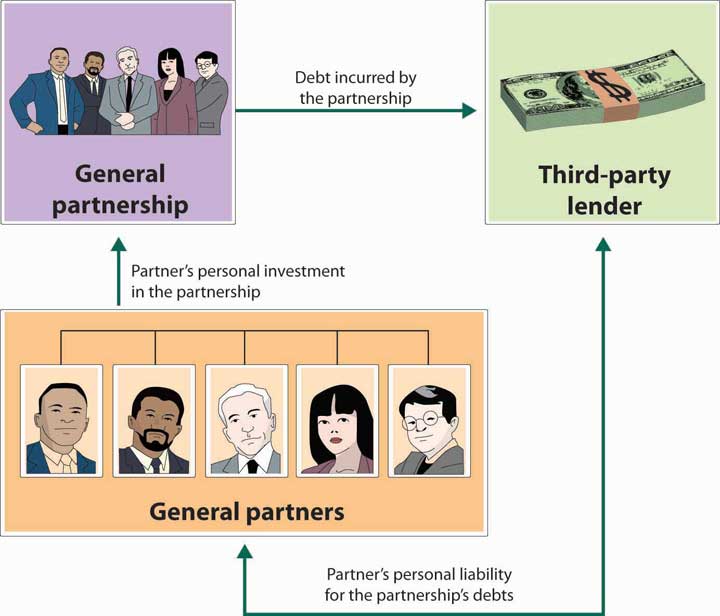

A general partnership is formed when two or more individuals come together and agree to share all their profits assets and the legal and financial liabilities. General partners are always required to share profits equally. Add your answer.

Personal assets are included in business debt. A sole proprietor has full control. A general partnership is an unincorporated business with two or more owners who share business responsibilities.

Helpful 1 Not Helpful 0. All partners in a general partnership are responsible for the business and are subject to. The assignee is responsible for a proportionate share of past and future partnership debts.

Which of the following best describes the role of a general partner in a limited partnership LP. Formed by two or more persons The owners are jointly and severally liable for any legal actions and debts the company may face. They cannot have a partnership until they determined how profits will be shared.

The general partner usually has an insignificant role in the overall business decisions of the limited partnership. Each of the partners in a general partnership co-owns the business and has a right to manage the business with other partners. A general partner is a co-owner with the other general partner of specific partnership property that is owned by The general partnership and it is this special legal status.

Which of the following statements best describes the effect of the assignment of an interest in a general partnership. Each partner has the rights and duties of a general partner. The main difference between a general partnership and a limited partnership is that A general partnership has unlimited liability for all partners while a limited partnership has limited liability In addition the liability of the personal assets.

A business owned by an individual. Responsibility for a personal situation. A Partnership involves two or more persons carrying on business with a view toward profits.

As a general partnership all partners have responsibility for operating the company. Which of the following statements best describes limited partnerships. Why might a limited partnership have a greater ability to raise capital than a general partnership.

Each general partner has unlimited personal liability for the debts and obligations. It is one of the most common legal entities to form a business. Textbook Solutions Expert Tutors Earn.

In a general partnership the relationship of the profit sharing ratios. Management and Control features Ordinary partnership matters are decided by majority vote of partners Extraordinary matters require unanimous consent. McCarthy of XYZ Co who requested that Adams pay10 000 to extinguish a debt owed by the partnership of Adams and Jefferson.

Generally each partner in a partnership has something to offer the business including labor ideas money andor property. The assignment automatically dissolves the partnership. What is one the following best describes a general partnership.

This right however can be modified by agreement of the partners. An association formed by two or more persons so they can profit from a business. An general partnership is a form of business entity.

The assignee becomes a partner. In an LLP there must be at least one general partner that is personally liable for the obligations of the partnership and has management responsibilities. The term includes all debt paid by a business as well as invested assets.

Partnership or sole proprietorship is when the partners operate the company with full control andor authority. In general partnership has unlimited liability for all partners while a limited partnership has lamentin liability This answer is. The general partner may participate in the business decisions of the limited partnership but will not be held personally liable for the.

Often times two or more companies or individuals will take part in a temporary business collaboration such as to perform one single task. General partnership is a partnership in which the partners have full or shared responsibility for operating the business. Which Of The Following Best Describes A General Partnership.

They are automatically entitled to a share proportional their relative contributions to the capital of the partnership. A General Partnership GP is an agreement between partners to establish and run a business together. A general partnership is characterized by which of the following.

Describe a general partnership in your own words. There are no general or limited partners in a LP. As part of a temporary collaboration businesses individuals and agencies may pool their resources.

Answer to Question 56 Which statement best describes the profit sharing relationship of a general partnership where the partners have agreed only on voting. Limited liability Company is a private company whereby the owners will be legally responsible for its debts based on the contribution of the capital thst they invested. Must be created by agreement proof of existence and estoppel.

Partnership Agreement Templates 16 Free Word Pdf Samples Contract Template General Partnership Agreement

Fin 370 Final Exam 54 Questions With Answers The New Exam 1st Set Buy This One 30 Off Exam Final Exams Finals

Reading Sole Proprietorship And Partnerships Introduction To Business

Comments

Post a Comment